Managing Family Wealth in Times of Economic Uncertainty

According to the Global Wealth Report 2018 released by Credit Suisse, China’s total household wealth exceeded $50 trillion in 2018, the second largest in the world. As ordinary Chinese households’ wealth increases, more people are beginning to turn their attention to long-term investment strategies.

In 2019, how can we effectively navigate the economic cycle amid uncertainties? Are there workable wealth allocation plans available for Chinese households? Professor Oliver Rui, Director of CEIBS Centre for Wealth Management and Co-Director of CEIBS Centre for Family Heritage, offers wealth management advice.

Let’s first look at expert predictions on China’s economic performance in 2019.

Leading financial institutions such as Goldman Sachs, Morgan Stanley and Deutsche Bank believe that China’s economy will grow at a rate of 6% to 6.5% in 2019, against the backdrop of a tightening financial environment and pressure from the China-US trade dispute.

Chief economists at China’s major brokers have also predicted that the country’s economic growth will slow down to between 6% and 6.3% in 2019.

Asset allocation is the key

How can we seize market opportunities in order to preserve and generate wealth, in a time of economic uncertainty? Much of western academic research reveals that asset allocation is the magic formula for households’ wealth management success.

An analysis of the quarterly investment data of 82 large U.S. pension funds between 1977 and 1987 reveals that their strategy for asset allocation was responsible for 91.5% of portfolio variance, while market timing and stock selection, which are traditionally regarded as key determinants of returns, only explained 1%-2% of the difference in income.

Image by Clker-Free-Vector-Images from Pixabay

One might argue that China’s historical data suggest otherwise: during certain periods some asset classes proved to be more worthwhile investment opportunities than others.

For instance, investing in constituent stocks of the GEM index in the last three years, or in trust or fixed income products issued by banks five years ago, or by buying real estate 10 years ago could have yielded very decent returns.

As China underwent a period of investment-driven rapid growth, the demand for financing surged, hence the relatively high returns on various classes of assets.

But as China’s economy grows at a slower pace, following a shift in focus from speed to quality, it may no longer be enough to rely on the familiar method of depending on popular asset classes.

As implicit guarantees are being phased out, single asset classes with high yield and low risk have become a thing of the past. In the new era, asset allocation will undoubtedly become one of the most important means of wealth management for Chinese households.

Rule No. 1: navigate different cycles

For asset managers, the first rule should be: help investors navigate different cycles. They are listed below in order of importance.

1. Demographic cycle

Currently, China’s economy has entered a “new normal” stage, where one of the major structural factors is an aging population.

Data show that a country's demographic structure is positively correlated with its GDP growth rates. When a country’s population remains stable, its economy grows at an average rate of 2.5%; and when a country’s working population increases by 1%, its GDP per capita will increase by 0.67%.

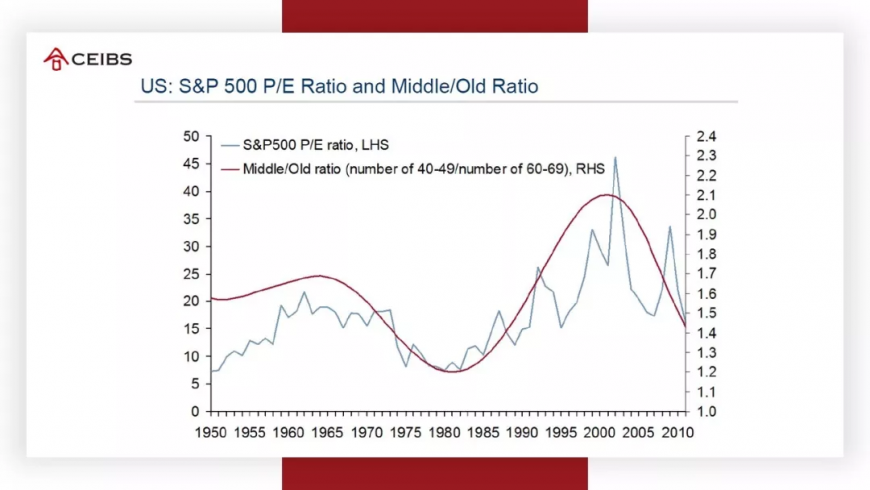

Demography can affect economic growth and, by extension, the price, demand and valuation of assets. Economists have found a positive correlation between stock yields and population size, with yields increasing by 1.4% for every 1% increase in the population.

From the above data from the Federal Reserve's San Francisco branch, it is obvious that as the proportion of investors in their forties increased, demand for equities rose, and the valuation of the U.S. stock market moved up, and vice versa.

Demographic cycles can also have an important impact on housing prices.

The average age of first-time homebuyers across the world is around 30. This is because during their 30s, as their family size increases, people want to improve their living conditions. So a higher proportion of people in their 30s means a greater demand for property. When the demographic dividend disappears, demand for real estate will naturally decline.

2. Dollar cycle

As we know, whenever the Fed eases its monetary policy, the US will flood the world with liquidity; when the Fed tightens up, liquidity is withdrawn from the world market.

The Federal Open Market Committee looks at only two indicators when formulating monetary policy: the first is unemployment or employment, and the second is inflation. When unemployment rises, the Fed eases its monetary policy; and when inflation rises, it indicates that the economy is overheating and the Fed is going to tighten.

However, when the Fed formulates monetary policy, it does not take into account the impact on other countries’ economies, thus leading to the dollar cycle.

Because of the dominance of the dollar, this cycle can be devastating. Since the 1980s, almost all of the major international economic recessions or financial crises have been caused by the dollar cycle.

3. Impact of low rates

The world has entered a low-interest-rate era. What impact will this have on our finances?

Fixed income products that we snapped up in the past will no longer meet our wealth management goals.

For example, let’s suppose your expected return on investment is 7.5%. Twenty years ago, if you had invested all your money in corporate bonds in the United States, you could have attained that goal very easily. In 2005, you would have had to allocate 50% of your wealth in riskier assets such as blue-chip stocks, small-cap companies, and private equity funds in order to achieve that goal. By 2015, you would have had to increase your exposure to fixed income and bonds from 52% to 12%, and would have needed to invest the other 88% in non-equity assets.

As populations age, people's life spans are getting longer, and they need to save more for old age. Chinese households need to keep increasing their proportion of investment in riskier assets.

4. Merrill Lynch Investment Clock

The Investment Clock splits the business cycle into four phases: recession, recovery, overheating and stagflation. Assets perform differently during each of these stages.

Historical data reveal the following investment rules:

Phase 1 – Recession: bonds are the best asset class.

Phase 2 – Recovery: stocks are the best asset class.

Phase 3 – Overheating: commodities are the best asset class.

Phase 4 – Stagflation: cash is king.

Image by stuart_roger_miles from Pixabay

Smart wealth management

When deciding how to allocate your assets there are a few rules of thumb worth noting. Never put all your eggs in the same basket; opt instead to diversify investments across asset classes and geographies. For average households, asset allocation strategies can vary depending on the age and wealth of the investor.

There are many formulas for asset allocation. Average middle class households may allocate their wealth for different purposes as outlined below:

- Living expenses: 10% of total income

- Life and health insurance: 20%

- Income generating investments: 30%

- Bank savings for future use, including travel, child’s education, and provision for old age: 40%.

Different assets play varied roles in wealth management, and their performance must be assessed using different criteria. At present, there is bedlam in China's wealth management scene, and investors’ sole focus on yields may cause good money to be driven out by bad.

We need to look at asset allocation in a new light: no assets are risk-free, high-yield and liquid. Investors must settle for something of a trade-off.

How can we effortlessly grow our wealth in 2019?

Sound asset allocation involves a six-step decision-making process:

Identify criteria for asset classes

(Yields, risks, etc.)

↓

Select best asset classes

↓

Establish strategic asset allocation

↓

Implement tactical asset allocation

↓

Rebalance tactical asset allocation

↓

Review process

Strategic vs tactical

Asset allocation can either be strategic or tactical. Strategic asset allocation generally has a duration of around 3-5 years, and the key lies in setting the risk exposure limit based on each household’s risk appetite.

Tactical asset allocation is a short-term view that looks for investment opportunities in the market, and generally has a duration of 3-12 months.

The most common asset allocation strategies include strategic and tactical weighting, with holdings of long-term strategic assets supplemented by short-term tactical assets.

For tactical asset allocation, the potential impact of interest rates should also be fully taken into account. In general, interest rates and asset prices are negatively correlated. When interest rates rise, the price of assets goes down. For this reason, many economists predict that 2019 could be a banner year for A-Shares.

Wealth must be managed, if it is to last. As the Chinese adage goes, “Shirtsleeves to shirtsleeves in three generations” – meaning that wealth gained in one generation will be lost by the third, if nothing is done to properly manage it.

We are no slaves to or masters of wealth, but stewards of wealth. Happiness should be our ultimate goal of wealth management. Properly managed wealth can make you, your family and people that you care about happier. Only when we appreciate this can we successfully navigate economic cycles and grow our wealth.

Oliver Rui is Professor of Finance and Accounting as well as Parkland Chair in Finance at CEIBS. He has approved the content of this article, which was compiled based on his speech at the 2019 New Year Wealth Management Forum.